Some costs are not 100% deductible for income tax and VAT. Depending on the business form, certain costs cannot be fully attributed to 'professional use'. For example, for 2021, a maximum of 50% of the VAT on car costs may be allocated to professional use, the remainder applies to private use.

While in the Netherlands the deductibility of costs is sometimes settled/corrected at the end of the financial year, the legislation in Belgium is stricter in this regard and states that this is processed accurately and correctly for every tax return.

When entering Expenses (Purchases), it is therefore important that the correct Cost Category is used.

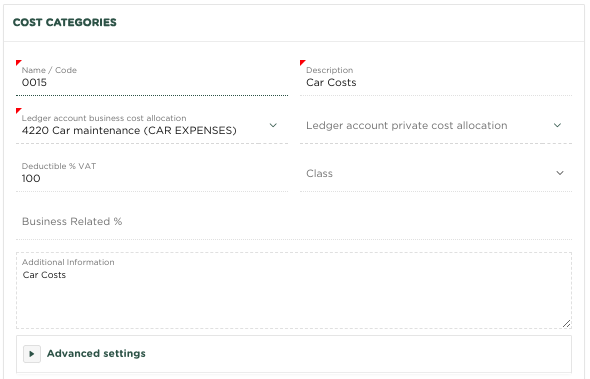

For each Cost Category it can be determined which percentage may be used for Income Tax (booking of professional costs and private related costs within the general ledger) and for the deductibility of VAT on certain costs.

The following example shows the deductibility (tax and VAT) for 'Car expenses'

If the costs of a repair to a passenger car are now entered, this Cost Category can now be used for correct processing within the general ledger and the VAT return. See the following example:

When entering an Expense for damage repairs to a passenger car, you now choose to post it to the Cost Category 'Car Costs'. After this Expense is made 'Final', it will be posted within the general ledger and processed within the VAT declaration.

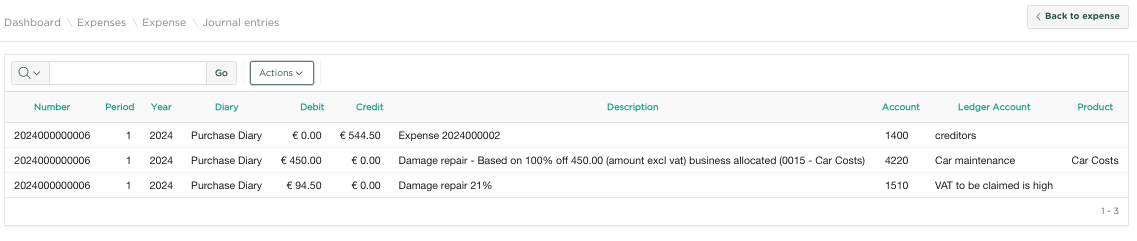

If we choose 'Journal entries' for the Expense, we see the following entries:

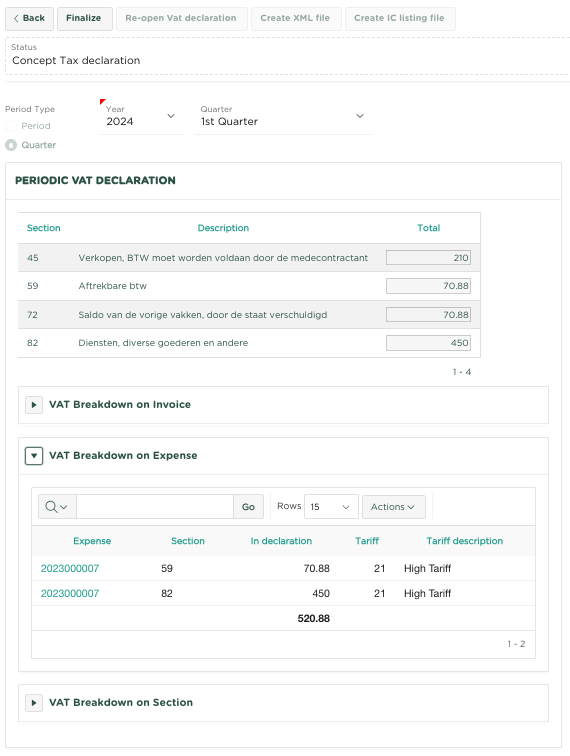

And if we choose the VAT declaration, we can see how the relevant Expense has been processed.

Related articles

-

Page:

-

Page:

-

Page:

-

Page:

-

Page: